While we always want to make our monthly mortgage payments, sometimes life can get in the way. If you’re in need of mortgage assistance, there are options available. One of those options involves writing a financial hardship letter. A financial hardship letter is a written document for your lender explaining why you’re unable to meet your financial obligations. Let’s learn more about how these letters work, when to use them and how to write an effective letter.

A financial hardship letter is a document in which you can detail your financial situation for your lender in hopes of getting a payment extension or reduction.

This letter should explain your current financial situation and why you’re unable to make payments. It should provide specific details about the hardship, such as when it began, how it was caused and how long it may continue.

A financial hardship letter may be needed when unfortunate events outside of your control keep you from being able to pay your mortgage. This letter aims to let the lender know why you haven’t been able to make payments. Some examples of situations your mortgage lender may consider a financial hardship include:

There are times when you may not need to write a hardship letter to receive financial assistance. Reach out to your service provider to see if a hardship letter is necessary.

Even if your service provider doesn’t require a letter of hardship, they’ll still likely want to see a list of monthly expenses to determine whether to assist you. Below are examples of expenses you should detail to your provider.

Remember to be as accurate as possible. For example, if you have monthly medical expenses, you should present documentation like medical bills to support them.

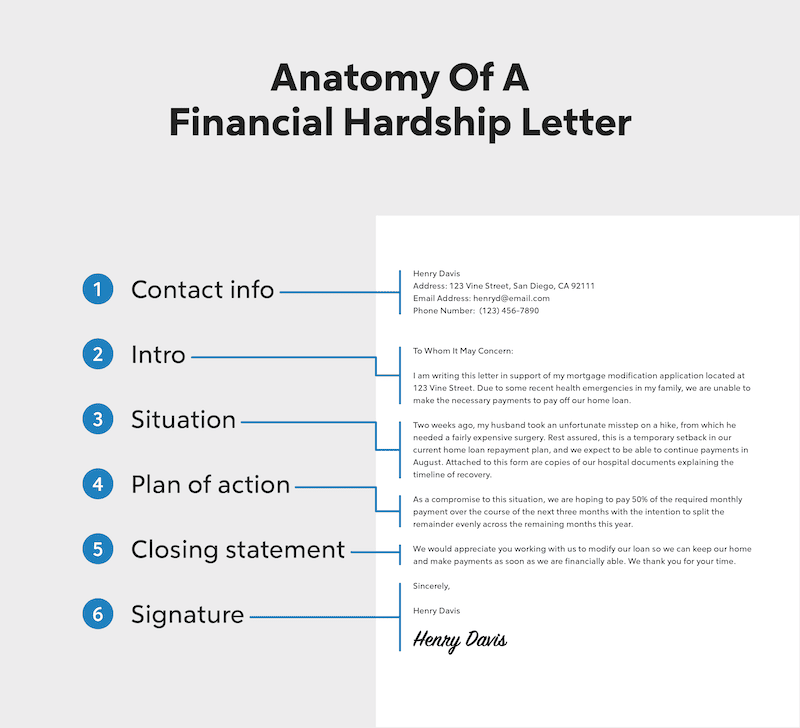

The typical format of a financial hardship letter is as follows:

After your letter is complete, it must be addressed to your lender. The letter may be mailed to your lender’s office or sent electronically via email. We recommend you check if your servicer requires a letter of hardship before submitting one. If they do require one, use the financial hardship letter example below as a guide or template for your letter.

Be mindful of the specific tips and advice below as you work through writing your letter.

It’s crucial to make sure the contact information you include in your letter is accurate. This better ensures your server will be able to contact you. We recommend doing a read-through of your letter for any errors before sending it to your server.

It’s best to be semi-formal in tone and specific in facts when writing this letter. While you may be feeling some very real emotional distress at the prospect of losing your home, the key here is to prove you qualify for a financial hardship exemption.

Remember to be original with your letter. You can use templates and examples – like the one we included above – for guidance, but your letter should be genuine and unique to your circumstances.

While it may be tempting to embellish your story or provide a full backstory, be concise, straightforward and honest with your letter. Keep the letter simple and direct with basic language to ensure it’s clear. Ideally, it should be one page (ideally less than 450 words), so don’t go into any unnecessary details.

You’ll need to explain exactly what is causing your delays or inability to make your mortgage payments. Don’t add fluff – be straightforward and honest with your answers.

Focus on the most important reason for assistance if there are multiple reasons why you can’t make payments. This will make the biggest difference in helping you get approved for a modification or refinance loan.

It’s important to provide as much factual information as necessary so your lender can get the full picture of your situation. You should include details about your income, assets and expenses.

Your servicer may just need a compilation of these various documents, rather than a hardship letter. It’s best to reach out to your lender beforehand to see which documents and information are necessary to send.

Commonly requested documents include:

Lenders will often request documentation to verify the information in the letter, so it’s important to only include accurate information.

You need to focus on your objectives and make it clear to your creditor that you have a plan they can help you with. Tell the creditor what you need help with and how to facilitate a solution to your financial issues. Keep in mind the options available to you will depend on what you are approved for and what your lender thinks you can do.

For mortgage relief, you may receive mortgage forbearance and deferment plans. Forbearance will allow you to temporarily pause your mortgage payments to give you time to catch up on finances. A deferment may be offered as well, which will push the payments you missed during the forbearance period to be due at the end of your loan term.

Speak with your servicer first to see what options they have available for you, such as: Below are some common options but they aren’t always guaranteed:

For example, you could ask for your monthly payments to be put on hold for three months or request to speak to them to discuss your options.

We recommend having your letter reviewed and proofread by a close family member or financial coach before sending it. This will help ensure you’ve included all the necessary details and that it’s free from grammar and spelling errors.

Remember, the letter should be addressed to the lender, and it’s important to include your contact information in case the lender has any questions. Finally, the letter should be signed by you, or the person requesting the hardship arrangement.

While it may not always be an option, if you can anticipate that you’ll be facing financial issues in the future, you may be able to refinance into a lower payment before facing the risk of default or foreclosure.

See recommended refinance options and customize them to fit your budget.

LMB Mortgage Services, Inc., (dba Quicken Loans), is not acting as a lender or broker. The information provided by you to Quicken Loans is not an application for a mortgage loan, nor is it used to pre-qualify you with any lender. If you are contacted by a lender or broker advertising within our network, your quoted rate may be higher depending on your property location, credit score, loan-to-value ratio, debt-to-income ratio, and/or other factors. Quicken Loans does not offer its matching services in all states. This loan may not be available for all credit types, and not all service providers in the Quicken Loans network offer this or other products with interest-only options. The information that we provide is from companies which Quicken Loans and its partners may receive compensation. This compensation may influence the selection, appearance, and order of appearance on this site. The information provided by Quicken Loans does not include all financial services companies or all of their available product and service offerings. Article content appears via license from original author or content owner, including Rocket Mortgage.

Note: Actions on this website are recorded for quality assurance or training purposes. Input of data constitutes consent.

Quicken Loans is a registered trademark of Rocket Mortgage, LLC, used under license by LMB Mortgage Services, Inc.

LMB Mortgage Services, Inc. | NMLS #167283

4859 W Slauson Ave #405 Los Angeles, CA 90056