An Arizona LLC Operating Agreement formats a composition to formally cite a written understanding of how a limited liability company will be run and which stipulated rights and duties will be assigned to one or more associated members. The provided state form has space to indicate company information, formation details, and whether the business will have one or multiple interest holders. LLCs can utilize the standard form or elect to use individualized multi-member or single-member operating agreements, depending on the preference of the founding members. It is not a requirement that all LLCs employ the use of this contract to achieve proper standing with the Arizona state government, but it can be helpful to present when seeking funding from investors or banking institutions.

Operating Agreements – § 29-3105

Definitions – “Operating Agreement” means the agreement, whether or not referred to as an operating agreement and whether oral, implied, in a record, or in any combination thereof, of all the members of a limited liability company, including a sole member, concerning the matters described in section 29-3105, subsection A. Operating agreement includes the agreement as amended or restated (§ 29-3102(17)).

Formation – § 29-3201

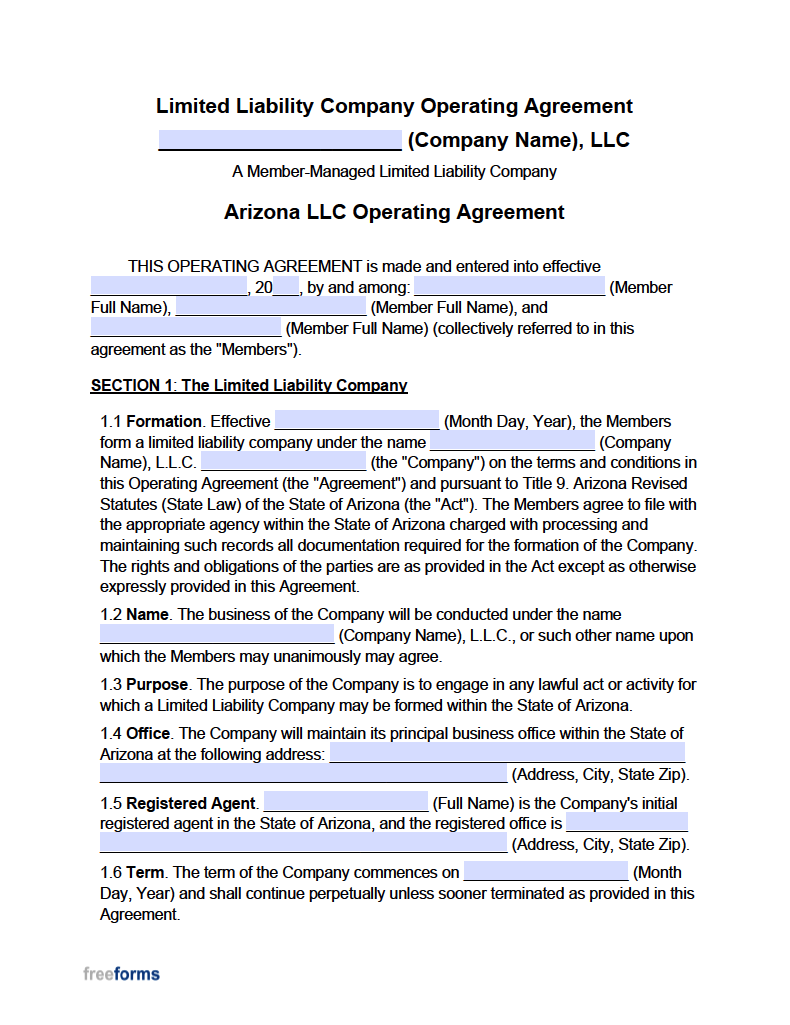

Multi-Member LLC Operating Agreement – Composes an organizational model for an LLC with two (2) or more interest holders to individualize a structured plan for operation and confirm member share percentages.

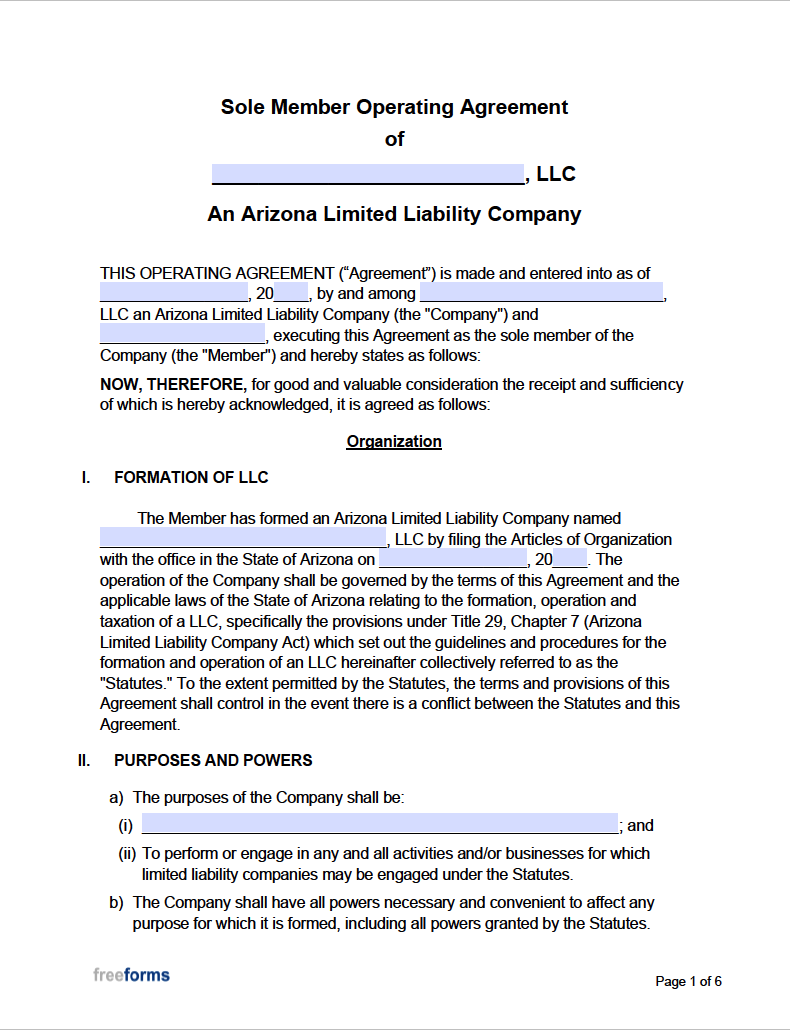

Single-Member LLC Operating Agreement – Organizes an explanation of company commitments and procedures for an LLC with one (1) owning individual.

Choosing to form a limited liability can be a favorable option for a number of reasons. LLC classification allows a company to be designated as a separate entity from its interest-holding members. This can effectively protect owning individuals’ personal assets from possible legal action associated with the business. Another plus of filing as an LLC is that it can potentially serve as a more favorable decision regarding tax purposes.

It is vital to secure a desired name to represent your business when establishing an LLC. There are several requirements that a chosen business name must adhere to by law to be used by a newly formed entity. One stipulation is that the proposed name cannot currently be in use by another company registered in Arizona. Use the Arizona Corporations Commission’s entity search tool to ensure your business name’s availability. Upon determining an available name, additional consideration must be made to confirm that the entity name meets the specifications of distinguishability as outlined on the ACC’s website. LLC names must also include “limited liability company” or an abbreviation such as L.L.C. to be deemed viable (§ 29-3112).

The business name can be designated when filing organization paperwork or reserved prior to application to secure a name for 120 days. Domestic LLCs that wish to reserve a name (optional) before applying for formation can apply online, by mail, or by fax as directed below:

By Mail:

Arizona Corporation Commission – Records Station

1300 W. Washington St.

Phoenix, AZ 85007

By Fax:

(602) 542-4100

Foreign LLCs cannot reserve a name using the same procedure as domestic LLCs but have the option instead to “register” a name with the ACC. Registering a business name for a foreign LLC sets aside a selected name to allow a 120-day period before applying for the authority to transact in Arizona. Foreign LLC name registration requires an active ACC eCorp Account to apply online.

Every Arizona company must appoint an individual or outside company responsible for accepting any delivered correspondence on behalf of the LLC. If the chosen statutory agent is an individual, they must be eighteen (18) or older and have a physical address located within the state. Limited liability companies that elect to contract a commercial provider of the service must ensure that the designated company is either a registered domestic corporation or LLC or a foreign corporation or LLC authorized to transact in Arizona (§ 29-3115). Once selected, the Statutory Agent Acceptance (Form M002) can be completed for submission along with the articles of organization in the following step.

Formally registering an LLC will require your business to file articles of incorporation with the ACC. Applying entities with an address found within Arizona can file articles of organization domestically, while those businesses located out-of-state will follow instructions to file foreign registration. Submission of applications can be carried out online or by mail, contingent on the preference of the company and its members:

Once the applicable organizational form is completed, additional documents will need to be completed and sent in along with the application:

After all paperwork is finalized, it can be sealed in a stamped envelope for delivery to the ACC headquarters:

Arizona Corporations Commission

Corporate Filings Section

1300 W. Washington St.

Phoenix, AZ 85007

For some newly formed LLCs, it may be necessary to publicly announce the information about the company’s official formation within sixty (60) days of approval from the state (§ 29-3201(G)). Depending on the county associated with the company address, publication in a local newspaper will be mandated for every county with a population of fewer than 800,000 residents. This includes all Arizona counties except for Maricopa and Pima counties, which will instead record the data in the county database. Formal notice must be printed consistently for a three (3) week period and can be achieved by commissioning one of the publications found in the ACC’s Newspaper Listing. Upon completion of the requirement, the newspaper will issue an Affidavit of Publication that can be retained for record or submitted to the ACC.

When the official processing of the formation filing has been submitted and approved by the state governments, it can be a constructive decision to draw up a legal understanding of how the LLC will operate moving forward. Within the form, there are multiple sections to denote company procedures and rules along with the duties, rights, and ownership percentages of each confirmed member. Click on the link below that corresponds to the number of interest-holding members associated with your LLC:

It is recommended to fill out the form and sign it before a notary professional as a precautionary measure to certify the document’s execution.

The Internal Revenue Service has incorporated a system to identify companies registered to do business in the United States, each by a unique identifying number. In most cases, a Federal Employer Identification Number or FEIN must be obtained by an LLC to facilitate the hiring of employees, seeking licenses/permits, and securing bank loans.

The simplest way to gain access to an individualized EIN for your business can be achieved electronically by visiting the IRS website and proceeding as directed with the Online EIN Assistant Service. LLCs that would rather submit by mail or fax can instead download the Application for Employer Identification Number (Form SS-4) for completion. Upon finalization, the form can be mailed or faxed to the address or fax number corresponding to your state, found on the IRS chart of addresses and phone numbers.